electric car company incentive

Since the lease costs are covered by scheme there are no. Incentives are personalized for where you live.

Germany Sets Out Major Cash Incentive For Electric Car Buyers Germany News And In Depth Reporting From Berlin And Beyond Dw 18 05 2016

An electric car rebate is a huge incentive to purchase an electric vehicle EV or a plug-in electric vehicle PEV.

. Stay Connected To Your World And Make Your Ride Smarter. To qualify the battery must have at least a 5 kilowatt. Small neighborhood electric vehicles do not qualify for this credit but they may qualify for another.

Local and Utility Incentives. The credit amount will vary based on the capacity of the battery used to power the vehicle. The Federal EV Incentive is currently worth up to 7500 for eligible vehicles and the amount varies based on the capacity of the battery within the car.

In addition there is a scrappage bonus for. When you apply youll need to include the following. Explore The 2020 LEAF Now.

30-Day Money Back Guarantee On All Used Cars. The credit amount will vary based on the capacity of the battery used to power the vehicle. Listed incentives may not be available at any given time.

Image of VinFast electric vehicles. In order to receive the money you need to fill out an application here. The Federal EV incentive is a tax credit available for buying a hybrid or fully electric vehicle.

You may be eligible for a range of incentives including EV rebates EV tax credits and various other benefits. On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure. A Vietnamese automaker has announced plans to build a 4 billion electric-vehicle assembly and battery-manufacturing plant at Triangle Innovation Point in Moncure about 30 miles west of the Triangle.

Electric Cars Eligible for the Full 7500 Tax Credit Audi. Find out how much you could save depending on where you are in the car-buying process. State andor local incentives may also apply.

The Electric Vehicle Homecharge Scheme EVHS provides a grant of up to 75 percent or up to 350 including VAT towards the cost of installing an EV charge point at your domestic property. Available in Select Stores. Commercial customers who purchase and install EVSE can receive up to 2000 for each charger and up to four rebates per year.

Incentives Package Worth 12 Billion Draws Electric Car Plant To NC. Electric Vehicles Solar and Energy Storage. Ad 2022s Car of the Year Is the Longest Range Fastest Charging Electric Car in the World.

ETron EV eTron Sportback EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley. Build Locate Today. Energy discounts typically take the form of discounted off-peak electric rate pricing incentives and assistance for installing home EV chargers or solar panels and cash rebates for purchasing new or used EVs generally below a defined mileage.

Rebates up to 4000 on a Pre-Owned EV. You do not get the tax credit if you only lease the vehicle. CALeVIP Alameda County Incentive Project.

Quality Durability Backed By Our 10 Year100000 Mile Limited Powertrain Warranty. Relative to a traditional electrical motor the innovative configuration and control of the AMFA yields significant size weight and price reductions while increasing power output. Residential Level 2 EV Charger Incentive Up to 250 - Entergy.

The 2021 update of ACEAs comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 EU member states looking at tax benefits related to vehicle acquisition and ownership as well as company cars and purchase incentives such as bonus payments or premiums for buyers. This means employees save 12 on their National Insurance contributions as well as 20 or 40 depending on their marginal income tax rate. Eversource and United Illuminating are offering their customers a rebate of more than 50 for the purchase and installation of a Level 2 Smart Charger with WiFi capability.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Charge Up New Jersey promotes clean vehicle adoption in the state by offering incentives of up to 5000 for the purchase or lease of new eligible zero.

As well as incentivising electric vehicles the government also offers funding towards installing an electric or plug-in hybrid car charger at home. Visit our digital configurator to get started customizing your new electric vehicle. Electric vehicles qualify for the Salary Sacrifice scheme the scheme allows employees to pay for the lease of an electric vehicle through their pre-tax income.

Through the Electric Equipment and Electric Vehicle Supply Equipment EVSE Incentive Entergy customers may be eligible to receive an 250 incentive for purchasing a Level 2 EV charger. As an electric vehicle EV driver you may qualify for a variety of rebates and incentives. Visit FuelEconomygov for more information.

For electric vehicles this in turn provides an incentive to buy. Ad Goodbye Gas Stations Enjoy The Perks Of Going Electric. NEWINGTON Electric vehicle owners now have an incentive to install a car-charging system at their home through a collaboration between utility companies and the state.

The federal government is fueling the carbon-conscious push to go green by offering some attractive incentives in hefty tax credits. An ecobonus of 6000 Euros can be claimed for the purchase of an electric car but may not exceed 27 percent of the vehicle value. Axiflux is the creator of the Adaptive Magnetic Flux Array - the worlds first modular real-time software-reconfigurable electric motor and generator.

Delaware Electric Cooperative provides a one-time 200 billing credit for buyers of EVs. Ad Get it Delivered or Pick it Up with Express Pickup. CALeVIP Alameda County Incentive Project provides rebates to entities toward the purchase and installation of EV chargers.

All electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500. Ad Check Out the Kia SUV Vehicle Lineup. Compare Models and Find Your Perfect Match.

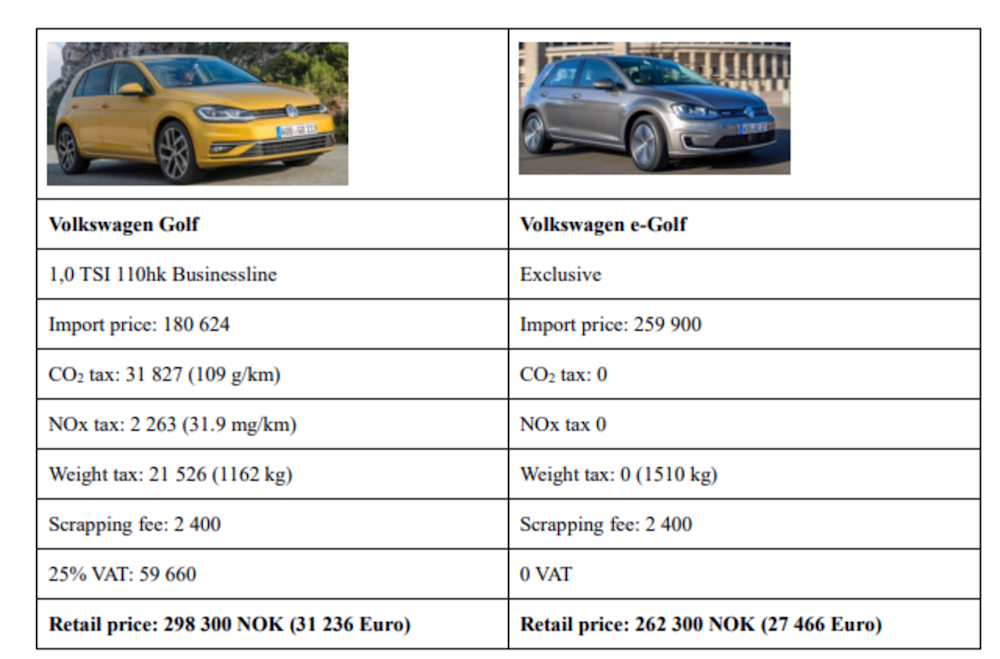

Electric Vehicles As An Example Of A Market Failure

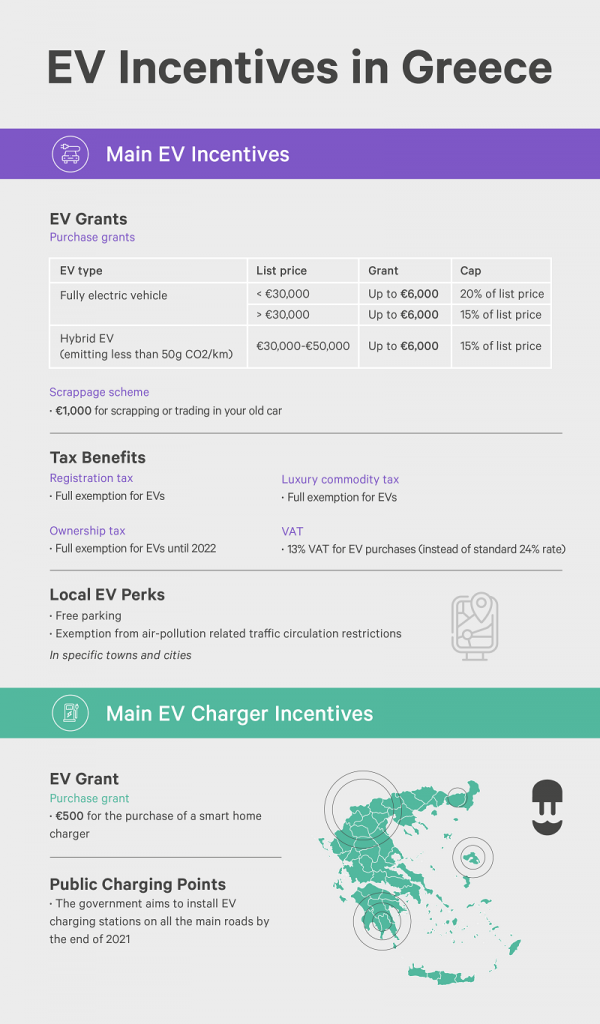

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

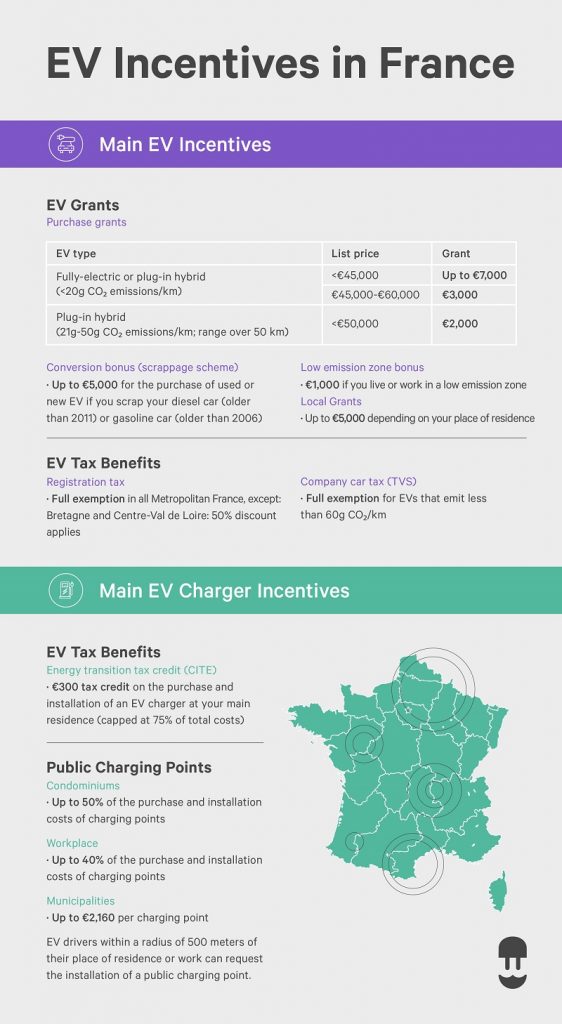

Ev Incentives In France Complete Guide Wallbox

Encouraging New Choices Through Incentives For Electric Vehicles Apex Clean Energy

Ev Incentives Ev Savings Calculator Pg E

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Economic Recovery Packages In Response To Covid 19 Another Push For Electric Vehicles In Europe International Council On Clean Transportation

Queensland Introduces Ev Purchase Incentives Electrive Com

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Thailand Issues New Incentive Package For Electric Vehicle Industry

A Complete Guide To Ev Ev Charging Incentives In The Uk

Electric Vehicles Tax Benefits And Purchase Incentives In The Eu By Country Acea European Automobile Manufacturers Association